President John F. Kennedy Assembles a Task Force Aimed at Increasing Foreign Investors in U.S. Securities and Businesses

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $5 |

| $50 | $10 |

| $200 | $25 |

| $500 | $50 |

About Auction

Dec 6, 2023

Boasting 500+ rare and remarkable lots, RR Auction's December Fine Autographs and Artifacts sale features special sections dedicated to World War II and Science & Technology. RR Auction support@rrauction.com

- Lot Description

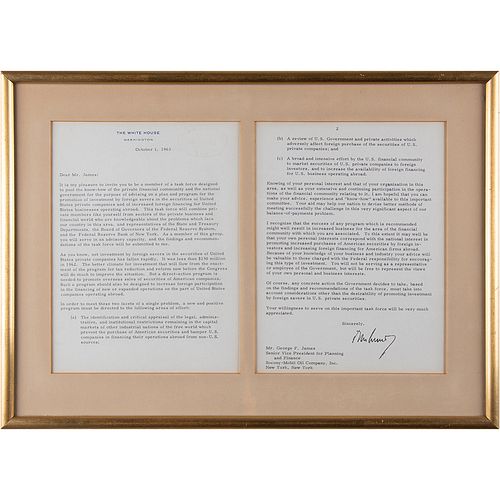

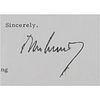

TLS as president signed “John Kennedy,” two pages, 7.25 x 9.75, White House letterhead, October 1, 1963. Letter to George F. James, Senior Vice President for Planning and Finance of the Socony-Mobil Oil Company, in full: “It is my pleasure to invite you to be a member of a task force designed to pool the know-how of the private financial community and the national government for the purpose of advising on a plan and program for the promotion of investment by foreign savers in the securities of United States private companies and of increased foreign financing for United States businesses operating abroad. This task force will combine private members like yourself from sectors of the private business and financial world who are knowledgeable about the problems which face our country in this area, and representatives of the State and Treasury Departments, the Board of Governors of the Federal Reserve System, and the Federal Reserve Bank of New York. As a member of this group, you will serve in an advisory capacity, and the findings and recommendations of the task force will be submitted to me.

As you know, net investment by foreign savers in the securities of United States private companies has fallen rapidly. It was less than $150 million in 1962. The better climate for investment that will flow from the enactment of the program for tax reduction and reform now before the Congress will do much to improve the situation. But a direct-action program is needed to promote overseas sales of securities of American companies. Such a program should also be designed to increase foreign participation in the financing of new or expanded operations on the part of United States companies operating abroad.

In order to meet these two facets of a single problem, a new and positive program must be directed to the following areas of effort:

(a) The identification and critical appraisal of the legal, administrative, and institutional restrictions remaining in the capital markets of other industrial nations of the free world which prevent the purchase of American securities and hamper U. S. companies in financing their operations abroad from non-U. S. sources;

(b) A review of U. S. Government and private activities which adversely affect foreign purchase of the securities of U.S. private companies; and

(c) A broad and intensive effort by the U. S. financial community to market securities of U. S. private companies to foreign investors, and to increase the availability of foreign financing for U.S. business operating abroad.

Knowing of your personal interest and that of your organization in this area, as well as your extensive and continuing participation in the operations of the financial community relating to it, I am hopeful that you can make your advice, experience and ‘know-how’ available to this important committee. Your aid may help our nation to devise better methods of meeting successfully the challenge in this very significant aspect of our balance-of-payments problem.

I recognize that the success of any program which is recommended might well result in increased business for the area of the financial community with which you are associated. To this extent it may well be that your own personal interests correspond with the national interest in promoting increased purchases of American securities by foreign investors and increasing foreign financing for American firms abroad. Because of your knowledge of your business and industry your advice will be valuable to those charged with the Federal responsibility for encouraging this type of investment. You will not be serving as a representative or employee of the Government, but will be free to represent the views of your own personal and business interests.

Of course, any concrete action the Government decides to take, based on the findings and recommendations of the task force, must take into account considerations other than the desirability of promoting investment by foreign savers in U. S. private securities. Your willingness to serve on this important task force will be very much appreciated.” Matted and framed to an overall size of 18.75 x 13.75. In fine condition, with trivial brushing to the signature. - Shipping Info

-

Bidder is liable for shipping and handling and providing accurate information as to shipping or delivery locations and arranging for such. RR Auction is unable to combine purchases from other auctions or affiliates into one package for shipping purposes. Lots won will be shipped in a commercially reasonable time after payment in good funds for the merchandise and the shipping fees are received or credit extended, except when third-party shipment occurs. Bidder agrees that service and handling charges related to shipping items which are not pre-paid may be charged to a credit card on file with RR Auction. Successful international Bidders shall provide written shipping instructions, including specified Customs declarations, to RR Auction for any lots to be delivered outside of the United States. NOTE: Declaration value shall be the item’(s) hammer price and RR Auction shall use the correct harmonized code for the lot. Domestic Bidders on lots designated for third-party shipment must designate the common carrier, accept risk of loss, and prepay shipping costs.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB

![[ABOLITION] Rare 1804 Anti-Slavery Pamphlet, One of Earliest Known](https://s1.img.bidsquare.com/item/m/2969/29696581.jpeg?t=1TL9FO)

![[AMBROTYPE] Children and Rabbit](https://s1.img.bidsquare.com/item/m/2903/29032056.jpeg?t=1TsHTb)

![[EARLY PHOTOGRAPHY] Photographer & Studio CDVs](https://s1.img.bidsquare.com/item/m/2900/29009609.jpeg?t=1TrhUL)

![[CIVIL WAR] Paralyzed WIA Confederate Veteran and his Black Servant CDV](https://s1.img.bidsquare.com/item/m/2900/29009605.jpeg?t=1TrhPc)

![[AFRICAN AMERICANA] Boy Wearing Top Hat](https://s1.img.bidsquare.com/item/m/3009/30096223.jpeg?t=1TVkct)

![[LINCOLN] Candlestick Attributed to Abraham Lincoln](https://s1.img.bidsquare.com/item/m/2903/29032115.jpeg?t=1TsIgs)

![[NATIVE AMERICANS] Impressive Group of Ten (10) Native American Cabinet Cards](https://s1.img.bidsquare.com/item/m/2903/29032168.jpeg?t=1TsIyk)

![[SLAVE BADGE] 1814 Charleston "Servant" Slave Hire Badge](https://s1.img.bidsquare.com/item/m/2903/29032208.jpeg?t=1TsIUc)