[Hamilton, Alexander] [Sherman, Roger] Report from the Commissioners for Purchasing the Public Debt

About Seller

2400 Market St

Philadelphia, PA 19147

United States

Established in 1805, Freeman’s Auction House holds tradition close, with a progressive mind-set towards marketing and promotion, along with access to a team of top experts in the auction business. And now with offices in New England, the Southeast, and on the West Coast, it has never been easier to ...Read more

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

About Auction

Oct 25, 2021

Freeman's is honored to present The Alexander Hamilton Collection of John E. Herzog, a single-owner sale of Alexander Hamilton material, on October 25. Curated by Darren Winston, Head of the Books and Manuscripts Department. Freeman's info@freemansauction.com

- Lot Description

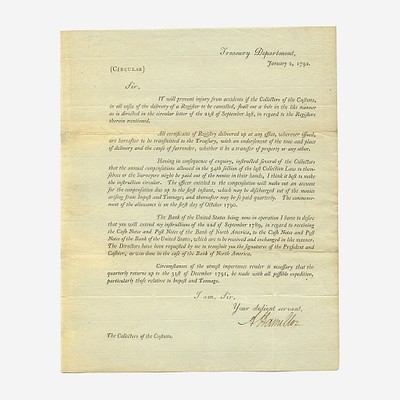

[Hamilton, Alexander] [Sherman, Roger] Report from the Commissioners for Purchasing the Public Debt

Founding Father Roger Sherman's copy of a report from the commission assigned to oversee the retirement of the national debt

(Philadelphia): Printed by Childs and Swaine, (1792). First edition. Folio, 13 5/8 x 8 1/2 in. (346 x 216mm). 19 pp. Founding Father Roger Sherman's copy, with his inscription and initials on front wrapper: "Report on purchase of Debt/R.S." Contemporary limp blue wrappers, original thread sound, lightly darkened, scattered minor soiling; all edges untrimmed; bottom third of title-page torn away, but with no loss to text; in brown cloth fall-down-back box and chemise. Evans 24291

A scarce and early government report from the Commissioners of the Sinking Fund, the commission established to oversee the economic plan established by Secretary of the Treasury Alexander Hamilton to retire the national debt over time. The commission consisted of Vice President John Adams, Secretary of State Thomas Jefferson, Attorney General Edmund Randolph, Chief Justice John Jay, as well as Hamilton.

By the end of the American Revolution the consolidated debt incurred by the United States was over $70 million. To manage this staggering amount, Ron Chernow observes that "To make sure the debt was extinguished over time, Hamilton proposed the creation of a sinking fund, financed by post-office revenues and manned by the government's chief officers...It would sequester revenues from the sudden whims of grasping politicians who might want to raid the Treasury for short-term gain. The sinking fund would retire about 5 percent of the debt each year until it was paid off. Because outstanding bonds currently traded below their original face value, such purchases would benefit the government as the securities rose in price. Thus, the government would profit from the rising prices alongside private investors..." Hamilton's plan helped secure the government's credit, and burnish its financial standing and reputation internationally as it retired the debt. This report, submitted by Secretary of State Thomas Jefferson as de facto head of the commission, on November 17, 1792, records public stock purchases between March 21 and October 31, 1792, as well as statements of accounts for transactions from the previous year.

William G. Anderson explains in The Price of Liberty: The Public Debt of the American Revolution regarding the sinking fund and Hamilton's financial programs: "Hamilton's fiscal program only funded the debts of the Revolution; it did not pay them...A sinking fund was created to redeem the stocks, and in 1795 the stocks were made receivable in payment for public lands. However, redemption proceeded slowly. Hamilton purposely saw to it that the sinking fund was poorly endowed. Hamilton, reflecting the ideas of (Sir Robert) Walpole and (Robert) Morris, did not wish to see the debt paid off rapidly. Indeed, for Hamilton the debt was a 'national blessing,' since it created a powerful group of people, public creditors, who now had a vested interest in seeing that the new government succeeded, and the stock certificates were used to finance the Bank of the United States and general economic growth in America. He had only created the sinking fund to give the appearance that the debt was being paid. Hamilton was convinced that in things pertaining to public credit, nothing counted quite as much as 'sounds and appearances.' Hamilton's reasoning proved initially successful. By July 1791 the market price of the 6 percent stock was at par, and through 1792 they traded at par or slightly above."

Roger Sherman (1721-93) was an American merchant, statesman, and Founding Father, from Connecticut. He is the only person to sign the Declaration of Independence, the Continental Association, the Articles of Confederation, and the Constitution. Under the act of 1790 that created the sinking fund, the commissioners were required to submit a report on the purchases of public debt to the presiding officers in Congress within 14 days of the beginning of each Congressional session. The above report is the only one submitted by Jefferson during his tenure as Secretary of State. John Adams submitted the other three reports issued by the commission between 1790-93. Sherman was a United States Senator from Connecticut, when he received this copy.

- Shipping Info

-

No lot may be removed from Freeman’s premises until the buyer has paid in full the purchase price therefor including Buyer’s Premium or has satisfied such terms that Freeman’s, in its sole discretion, shall require. Subject to the foregoing, all Property shall be paid for and removed by the buyer at his/ her expense within ten (10) days of sale and, if not so removed, may be sold by Freeman’s, or sent by Freeman’s to a third-party storage facility, at the sole risk and charge of the buyer(s), and Freeman’s may prohibit the buyer from participating, directly or indirectly, as a bidder or buyer in any future sale or sales. In addition to other remedies available to Freeman’s by law, Freeman’s reserves the right to impose a late charge of 1.5% per month of the total purchase price on any balance remaining ten (10) days after the day of sale. If Property is not removed by the buyer within ten (10) days, a handling charge of 2% of the total purchase price per month from the tenth day after the sale until removal by the buyer shall be payable to Freeman’s by the buyer. Freeman’s will not be responsible for any loss, damage, theft, or otherwise responsible for any goods left in Freeman’s possession after ten (10) days. If the foregoing conditions or any applicable provisions of law are not complied with, in addition to other remedies available to Freeman’s and the Consignor (including without limitation the right to hold the buyer(s) liable for the bid price) Freeman’s, at its option, may either cancel the sale, retaining as liquidated damages all payments made by the buyer(s), or resell the property. In such event, the buyer(s) shall remain liable for any deficiency in the original purchase price and will also be responsible for all costs, including warehousing, the expense of the ultimate sale, and Freeman’s commission at its regular rates together with all related and incidental charges, including legal fees. Payment is a precondition to removal. Payment shall be by cash, certified check or similar bank draft, or any other method approved by Freeman’s. Checks will not be deemed to constitute payment until cleared. Any exceptions must be made upon Freeman’s written approval of credit prior to sale. In addition, a defaulting buyer will be deemed to have granted and assigned to Freeman’s, a continuing security interest of first priority in any property or money of, or owing to such buyer in Freeman’ possession, and Freeman’s may retain and apply such property or money as collateral security for the obligations due to Freeman’s. Freeman’s shall have all of the rights accorded a secured party under the Pennsylvania Uniform Commercial Code.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB![[Hamilton, Alexander] [Sherman, Roger] Report from the Commissioners for Purchasing the Public Debt](https://s1.img.bidsquare.com/item/l/9470/9470963.jpeg?t=1MwoES)

![[Hamilton, Alexander] [Sherman, Roger] Report from the Commissioners for Purchasing the Public Debt](https://s1.img.bidsquare.com/item/s/9470/9470963.jpeg?t=1MwoES)