[Hamilton, Alexander] [Panic of 1792] Manuscript Document

About Seller

2400 Market St

Philadelphia, PA 19147

United States

Established in 1805, Freeman’s Auction House holds tradition close, with a progressive mind-set towards marketing and promotion, along with access to a team of top experts in the auction business. And now with offices in New England, the Southeast, and on the West Coast, it has never been easier to ...Read more

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

About Auction

Oct 25, 2021

Freeman's is honored to present The Alexander Hamilton Collection of John E. Herzog, a single-owner sale of Alexander Hamilton material, on October 25. Curated by Darren Winston, Head of the Books and Manuscripts Department. Freeman's info@freemansauction.com

- Lot Description

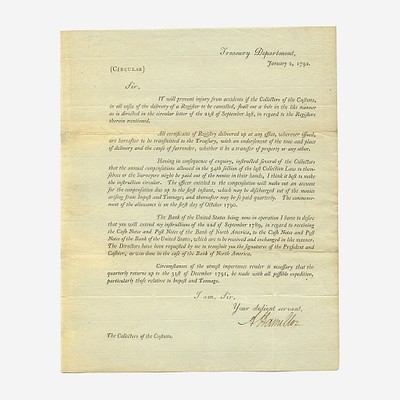

[Hamilton, Alexander] [Panic of 1792] Manuscript Document

The Boston branch of the First Bank of the United States carries out Alexander Hamilton's directions to help stop the Panic of 1792, America's first financial crisis

Boston: Office of Deposit & Discount, April 4, 1792. One sheet, 10 3/4 x 7 3/4 in. (273 x 197 mm). Manuscript receipt in a secretarial hand, signed by the Committee of Directors of the Office of Deposit & Discount at Boston, John Codman, John C. Jones, and Jonathan Mason, Jr., recording $35,000 received by Nathaniel Appleton Esq., Commissioner of Loans of the United States of America in the State of Massachusetts: "to be carried to the Credit of the Treasurer of the United States & appropriated to the payment of Interest due to the Creditors of the United States in conformity to the request of the Secretary of the Treasury of the United States in his Letter of 22d March 1792 and the directions of the President of the Bank of the United States in his Letter of 22d March 1792." Docketed on verso. Creasing from original folds; residue along edges from previous mount.

A rare manuscript document attesting to Hamilton's rapid and decisive actions in helping stop the Panic of 1792, America's first financial crisis.

This receipt records $35,000 received by Nathaniel Appleton, Commissioner of Loans for the State of Massachusetts, under the direction of Secretary of the Treasury Alexander Hamilton, to pay interest on the national debt, in an effort to relieve pressure on the First Bank of the United States during the Panic. In an earlier letter dated March 22, 1792, and mentioned in the above document, Hamilton instructed Appleton to "avail yourself of all the specie in the hands of the Collector of Boston, excepting only the sum of 6,000 Dollars, which is to be retained by him, to meet certain bills of the Commissioner of Loans in New Hampshire, which he is authorized to direct to the Collector. The remaining specie the Collector is to deposit in the Boston Branch of the Bank of the United States, for the purpose of paying the interest on the public debt. He is also to pay in all the notes of the Bank of the US to be deposited in such way or form as the said Branch shall determine to receive the paper of the Bank of the United States. You are further to avail yourself of all the monies received, when this reaches you, or to be received on or before the 2d of April, by the Bank of Massachusetts, taking the greatest care so to manage and conduct the receipt of this money as to produce to them no avoidable inconvenience or derangement. The sum they held in specie at the last return, on the 24th of February, was 31,197. 50/100 Dollars, and in the Bills or notes of the Bank of the United States 620 Dollars. Since that, further sums have no doubt been transmitted, and additions may be made before the expiration of the 2d of April..." (Founders Online, National Archives).

The Panic occurred between March and April of 1792, but traces to late 1791, and stems from the rapid expansion of credit from the newly established First Bank of the United States and the unbridled speculation and insider trading of government securities led by William Duer, Alexander Macomb, and other bankers (see lots 20, 21). Through a convoluted plan by Duer to corner government securities, sell them at a profit overseas, and take over the Bank of New York, he borrowed heavily, even embezzling money while chairing the industrial planning group the Society for Establishing Useful Manufactures. By March, Duer had overextended himself trying to corner the market and defaulted on his obligations. When a suit against Duer, stemming from his embezzlement became public, coupled with the subsequent contraction of credit by the Bank, a panic ensued. Hamilton deflty managed the crisis by purchasing government securities through money in the sinking fund and helped restore liquidity in the financial markets. The economic recovery was swift and no recession occurred afterward. Duer and Macomb were both jailed. Duer spent the rest of his life behind bars, often with a guard stationed at his cell to protect him from those who had lost everything due to his greed.

According to Richard Sylla, the Panic could have destroyed the new nation, but due to Hamilton's intervention, it actually strengthened it and significantly contributed to the financial revolution ushered in by him, writing, "...it led directly to more effective securities trading and clearing system and to the founding, in 1792, of what would become the New York Stock Exchange. Further, because the Panic was contained, the U.S. financial system (especially in the Northeast, an entity more comparable to Great Britain or England in size and economic structure than the entire United States) continued to develop so rapidly that it would come to equal, even to surpass, that of Britain by the 1830s." (Richard Sylla, Robert E. Wright and David J. Cowen, Alexander Hamilton, Central Banker: Crisis Management during the U.S. Financial Panic of 1792, The Business History Review, Vol. 83, No. 1, A Special Issue on Scandals and Panics (Spring, 2009), pp. 61-86).

- Shipping Info

-

No lot may be removed from Freeman’s premises until the buyer has paid in full the purchase price therefor including Buyer’s Premium or has satisfied such terms that Freeman’s, in its sole discretion, shall require. Subject to the foregoing, all Property shall be paid for and removed by the buyer at his/ her expense within ten (10) days of sale and, if not so removed, may be sold by Freeman’s, or sent by Freeman’s to a third-party storage facility, at the sole risk and charge of the buyer(s), and Freeman’s may prohibit the buyer from participating, directly or indirectly, as a bidder or buyer in any future sale or sales. In addition to other remedies available to Freeman’s by law, Freeman’s reserves the right to impose a late charge of 1.5% per month of the total purchase price on any balance remaining ten (10) days after the day of sale. If Property is not removed by the buyer within ten (10) days, a handling charge of 2% of the total purchase price per month from the tenth day after the sale until removal by the buyer shall be payable to Freeman’s by the buyer. Freeman’s will not be responsible for any loss, damage, theft, or otherwise responsible for any goods left in Freeman’s possession after ten (10) days. If the foregoing conditions or any applicable provisions of law are not complied with, in addition to other remedies available to Freeman’s and the Consignor (including without limitation the right to hold the buyer(s) liable for the bid price) Freeman’s, at its option, may either cancel the sale, retaining as liquidated damages all payments made by the buyer(s), or resell the property. In such event, the buyer(s) shall remain liable for any deficiency in the original purchase price and will also be responsible for all costs, including warehousing, the expense of the ultimate sale, and Freeman’s commission at its regular rates together with all related and incidental charges, including legal fees. Payment is a precondition to removal. Payment shall be by cash, certified check or similar bank draft, or any other method approved by Freeman’s. Checks will not be deemed to constitute payment until cleared. Any exceptions must be made upon Freeman’s written approval of credit prior to sale. In addition, a defaulting buyer will be deemed to have granted and assigned to Freeman’s, a continuing security interest of first priority in any property or money of, or owing to such buyer in Freeman’ possession, and Freeman’s may retain and apply such property or money as collateral security for the obligations due to Freeman’s. Freeman’s shall have all of the rights accorded a secured party under the Pennsylvania Uniform Commercial Code.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB![[Hamilton, Alexander] [Panic of 1792] Manuscript Document](https://s1.img.bidsquare.com/item/l/9470/9470955.jpeg?t=1MwoES)

![[Hamilton, Alexander] [Panic of 1792] Manuscript Document](https://s1.img.bidsquare.com/item/s/9470/9470955.jpeg?t=1MwoES)

![[PEEPSHOW]. “World of Tomorrow” 1939 New York World's Fair ...](https://s1.img.bidsquare.com/item/m/3479/34797714.jpeg?t=1VIjxU)