[Hamilton, Alexander] [First Bank of the United States] First Bank of the United States Stock Certificate

About Seller

2400 Market St

Philadelphia, PA 19147

United States

Established in 1805, Freeman’s Auction House holds tradition close, with a progressive mind-set towards marketing and promotion, along with access to a team of top experts in the auction business. And now with offices in New England, the Southeast, and on the West Coast, it has never been easier to ...Read more

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

About Auction

Oct 25, 2021

Freeman's is honored to present The Alexander Hamilton Collection of John E. Herzog, a single-owner sale of Alexander Hamilton material, on October 25. Curated by Darren Winston, Head of the Books and Manuscripts Department. Freeman's info@freemansauction.com

- Lot Description

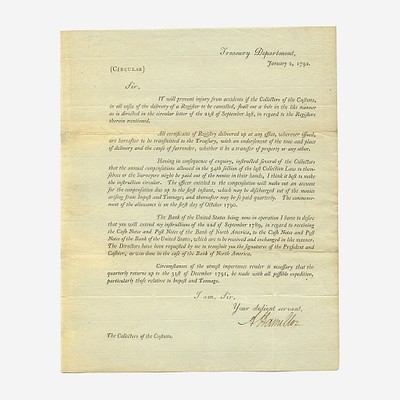

[Hamilton, Alexander] [First Bank of the United States] First Bank of the United States Stock Certificate

A rare share in the First Bank of the United States

Philadelphia, January 1, 1794. Engraved certificate, being one share in the First Bank of the United States (No. 1239), issued to Le chevalier de Segond. Lightly worn along top edge. A fine example.

A rare engraved certificate for one share in the Bank of the United States, the establishment of which was one of Alexander Hamilton's greatest accomplishments while serving as the first Secretary of the Treasury (see lot 14). Issued to Revolutionary War officer, Jacques, Chevalier de Segond (1758-1832), a native of Beausset in Provence, France. He volunteered in the American army in June 1777, fighting in the battles of Brandywine and Germantown, while serving as Captain in the Third Battalion of the Pulaski Legion. He fought and was captured in the southern campaign in the battle of Charleston and was released in a prisoner exchange in 1782. In 1783 he was promoted to Major, and soon after retired. He became a member of Society of the Cincinnati in 1812.

Alexander Hamilton first outlined his plans for a national bank in a report he submitted to Congress on December 14, 1790 (see lot 14). Influenced by the ideas of Sir Robert Walpole, Malachy Postlethwayt, Adam Smith, and modeled after the Bank of England, the First Bank of the United States (as it would be chartered), would not function like a typical bank of deposit and discount, but instead would be an active force to expand economic activity in the United States. Hamilton's vision was that the bank would issue and regulate a national currency in the form of paper money, provide a safe location to store public funds, perform commercial transactions like issuing loans for private citizens and businesses, and, importantly, act as the government's fiscal agent by providing it loans, collecting taxes, and paying debt. In the larger scheme, Hamilton argued, the bank would control inflation and deflation (a serious issue during after the Revolution), while also serving as a model for state banks.

The bill to charter the bank passed through both the Senate and House along partisan and geographical lines, with the northern majority firmly in support of the bank, and the southern minority, led by James Madison of Virginia, and Secretary of State Thomas Jefferson, against it. Jefferson, acting as de facto head of the opposition, argued that the creation of a national bank would create a monopoly at the expense of state banks, and promote policies that would mainly benefit northern merchants�who tended to be creditors�at the expense of southern farmers�who were typically debtors. Madison further argued that the creation of the bank was unconstitutional, asserting that the Constitution did not grant the government powers that were not specifically enumerated therein, in this case the ability of the government to create a corporation. When the bill reached the desk of President George Washington he was cautious to sign because of the partisan uproar, so he requested opinions on the Bank's constitutionality from Attorney General Edmund Randolph, Secretary of State Jefferson, and Hamilton. Randolph and Jefferson both opined against the bank, with Jefferson arguing that it violated the necessary-and-proper clause in Article I, Section 8. Hamilton defended against the Bank's constitutionality in a 15,000 word response, where he expounded and refined the idea of implied powers. Washington agreed with Hamilton's thorough assessment and signed the bill into law.

The Bank opened for business on December 12, 1791 with a 20-year charter. Thomas Willing, former president of the Bank of North America (a semi-national bank created by former Superintendent of Finance, Robert Morris), accepted the job as its first president. When the Bank opened it was capitalized with $10 million, $2 million of which was owned by the Federal government through a loan issued by the Bank, and the other $8 million owned by private investors. This size of this capitalization made it not only the largest financial institution in the nation, but also the largest corporation of any type in the country at that time. To capitalize the opening of the Bank, $8 million worth of shares (20,000 shares at $400 each) were sold to the public in July 1791�the largest public offering in the country up to that point�largely to foreign investors (as this share attests to) which led to a competitive secondary market for bank scrip. The initial offerings were not shares themselves, but subscriptions that acted as down payments for a future acquisition of a share. Three-fourths of the payment for these shares were to be made in public securities, the other quarter in gold and silver coins. Notes and bills of credit issued by the bank were subsequently accepted by the Federal government as payment for debts, allowing the notes to circulate as a de facto currency. The 25-member board of the Bank, including its president, was selected by its shareholders�and rotated frequently�but its operations were closely monitored by the Treasury Department in their ability to request reports and information, as often as every week. The Bank would be allowed to open branches wherever it saw fit, which saw many branches established in cities with major ports, as customs duties tended to be the main source of government revenue.

We can find no other examples of this certificate. Extremely rare.

Footnote:Jacques-Marie-Blaise Chevalier de Segond de Sederon (�James Segond�) was a native of Beausset in Provence who volunteered in the American army in 1777. He was made a captain in the Pulaski Legion in 1778 and fought at Brandywine, German-town, Whitemarsh, and in the Southern campaign, being captured at Charleston in 1780 and exchanged in November 1782.

Segond would be promoted to the rank of Major by special resolution of Congress on September 30, 1783. He would retire from the Continental Army on November 3 of that same year. The following year, we would join the Society of the Cincinnati.

Segond would go on to serve in Holland from 1785 to 1788; in Russia from 1788 to the end of 1790; and after a short period with the French armies, 1791 to 1793, he deserted to Austria.

- Shipping Info

-

No lot may be removed from Freeman’s premises until the buyer has paid in full the purchase price therefor including Buyer’s Premium or has satisfied such terms that Freeman’s, in its sole discretion, shall require. Subject to the foregoing, all Property shall be paid for and removed by the buyer at his/ her expense within ten (10) days of sale and, if not so removed, may be sold by Freeman’s, or sent by Freeman’s to a third-party storage facility, at the sole risk and charge of the buyer(s), and Freeman’s may prohibit the buyer from participating, directly or indirectly, as a bidder or buyer in any future sale or sales. In addition to other remedies available to Freeman’s by law, Freeman’s reserves the right to impose a late charge of 1.5% per month of the total purchase price on any balance remaining ten (10) days after the day of sale. If Property is not removed by the buyer within ten (10) days, a handling charge of 2% of the total purchase price per month from the tenth day after the sale until removal by the buyer shall be payable to Freeman’s by the buyer. Freeman’s will not be responsible for any loss, damage, theft, or otherwise responsible for any goods left in Freeman’s possession after ten (10) days. If the foregoing conditions or any applicable provisions of law are not complied with, in addition to other remedies available to Freeman’s and the Consignor (including without limitation the right to hold the buyer(s) liable for the bid price) Freeman’s, at its option, may either cancel the sale, retaining as liquidated damages all payments made by the buyer(s), or resell the property. In such event, the buyer(s) shall remain liable for any deficiency in the original purchase price and will also be responsible for all costs, including warehousing, the expense of the ultimate sale, and Freeman’s commission at its regular rates together with all related and incidental charges, including legal fees. Payment is a precondition to removal. Payment shall be by cash, certified check or similar bank draft, or any other method approved by Freeman’s. Checks will not be deemed to constitute payment until cleared. Any exceptions must be made upon Freeman’s written approval of credit prior to sale. In addition, a defaulting buyer will be deemed to have granted and assigned to Freeman’s, a continuing security interest of first priority in any property or money of, or owing to such buyer in Freeman’ possession, and Freeman’s may retain and apply such property or money as collateral security for the obligations due to Freeman’s. Freeman’s shall have all of the rights accorded a secured party under the Pennsylvania Uniform Commercial Code.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB![[Hamilton, Alexander] [First Bank of the United States] First Bank of the United States Stock Certificate](https://s1.img.bidsquare.com/item/l/9470/9470972.jpeg?t=1MwoET)

![[Hamilton, Alexander] [First Bank of the United States] First Bank of the United States Stock Certificate](https://s1.img.bidsquare.com/item/s/9470/9470972.jpeg?t=1MwoET)