[Hamilton, Alexander] [Bank of New York] Partially-Printed "Receivable" for the Bank of New York

About Seller

2400 Market St

Philadelphia, PA 19147

United States

Established in 1805, Freeman’s Auction House holds tradition close, with a progressive mind-set towards marketing and promotion, along with access to a team of top experts in the auction business. And now with offices in New England, the Southeast, and on the West Coast, it has never been easier to ...Read more

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

About Auction

Oct 25, 2021

Freeman's is honored to present The Alexander Hamilton Collection of John E. Herzog, a single-owner sale of Alexander Hamilton material, on October 25. Curated by Darren Winston, Head of the Books and Manuscripts Department. Freeman's info@freemansauction.com

- Lot Description

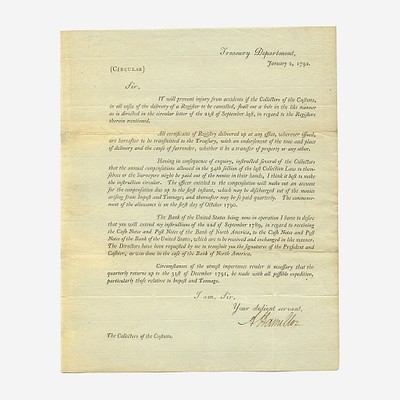

[Hamilton, Alexander] [Bank of New York] Partially-Printed "Receivable" for the Bank of New York

New York, December 16, 1791. One sheet, 4 3/4 x 7 3/4 in. (121 x 197mm). Partially-printed Bank of New York "Receivable" certificate (No. 22), for five shares, at $39.75 per share, signed by George Sutton: "On the 1st day of February 1792 I promise to receive from Mr. Daniel C. Verplanck or order five complete shares of the New York Bank Stock and to pay Them or order for the same at the rate of thirty nine & 3/4 advance..."; docketed on verso. Creasing from original folds. A fine example.

Referred to as a receivable, this is a pre-printed form so transactions like this one must have occurred on a fairly regular basis, but this is the only form of this type we have ever offered and it is the only one found in the Verplanck archive. The rapid rise in stock prices was probably the reason Verplanck failed to exercise the receivable option, which would explain why the document remained with his business papers. A rare and possibly unique example.

When British occupation of New York City ended on November 25, 1783, most of the city was in a shambles. Dwindling trade, scarce money, and falling prices exacerbated an already dire situation for the city's residents and merchants. Sensing a pending crisis, in March 1784 Alexander Hamilton organized a meeting with other New York merchants in an effort to stabilize the volatile financial situation. At Hamilton's urging they adopted a constitution written by him (one that would be replicated by banks across the nation), and in June, the Bank of New York was founded and opened for business at the Walton House in Lower Manhattan. In 1789, the Bank of New York provided the United States its first loan in order to pay the salaries of the U.S. Congressmen and President Washington, and later was instrumental in helping quell the Crisis of 1791 and Panic of 1792.

At the time this "receivable" was issued, the United States financial market was recovering from a bank scrip bubble that occurred the previous fall when the newly opened Bank of the United States started offering stock, leading to quickly rising and plummeting prices. Largely through the efforts of Hamilton and the cashier of the Bank of New York, William Seton, the government purchased $150,000 in New York public debt, and for the moment stabilized the market. Unbeknownst to Hamilton during this time were the actions of a cadre of New York bankers, led by financial speculator and former first Assistant Secretary of the Treasury, William Duer. Duer, alongside partner, Alexander Macombe, were attempting to manipulate the New York stock market by using large loans to buy massive amounts of government paper and bank stock in an attempt to corner the market, sell them cheap overseas at massive profits, and simultaneously secure a controlling stake in the Bank of New York. By the end of December 1791 the securities market was improving, but by March of the following year, when Duer defaulted on his massive loans and was jailed, a panic ensued after prices plummeted and credit was restricted. Once again Hamilton turned to Seton at the Bank of New York, and through Hamilton's quick efforts, a disaster was averted. Without Hamilton's intervention, the Panic could have inflicted a fatal blow to the new nation and Hamilton's agenda, yet the economy sprung back, and with the Buttonwood Agreement between Wall Street's brokers soon to be established, American financial dominance was secured. Rare.

- Shipping Info

-

No lot may be removed from Freeman’s premises until the buyer has paid in full the purchase price therefor including Buyer’s Premium or has satisfied such terms that Freeman’s, in its sole discretion, shall require. Subject to the foregoing, all Property shall be paid for and removed by the buyer at his/ her expense within ten (10) days of sale and, if not so removed, may be sold by Freeman’s, or sent by Freeman’s to a third-party storage facility, at the sole risk and charge of the buyer(s), and Freeman’s may prohibit the buyer from participating, directly or indirectly, as a bidder or buyer in any future sale or sales. In addition to other remedies available to Freeman’s by law, Freeman’s reserves the right to impose a late charge of 1.5% per month of the total purchase price on any balance remaining ten (10) days after the day of sale. If Property is not removed by the buyer within ten (10) days, a handling charge of 2% of the total purchase price per month from the tenth day after the sale until removal by the buyer shall be payable to Freeman’s by the buyer. Freeman’s will not be responsible for any loss, damage, theft, or otherwise responsible for any goods left in Freeman’s possession after ten (10) days. If the foregoing conditions or any applicable provisions of law are not complied with, in addition to other remedies available to Freeman’s and the Consignor (including without limitation the right to hold the buyer(s) liable for the bid price) Freeman’s, at its option, may either cancel the sale, retaining as liquidated damages all payments made by the buyer(s), or resell the property. In such event, the buyer(s) shall remain liable for any deficiency in the original purchase price and will also be responsible for all costs, including warehousing, the expense of the ultimate sale, and Freeman’s commission at its regular rates together with all related and incidental charges, including legal fees. Payment is a precondition to removal. Payment shall be by cash, certified check or similar bank draft, or any other method approved by Freeman’s. Checks will not be deemed to constitute payment until cleared. Any exceptions must be made upon Freeman’s written approval of credit prior to sale. In addition, a defaulting buyer will be deemed to have granted and assigned to Freeman’s, a continuing security interest of first priority in any property or money of, or owing to such buyer in Freeman’ possession, and Freeman’s may retain and apply such property or money as collateral security for the obligations due to Freeman’s. Freeman’s shall have all of the rights accorded a secured party under the Pennsylvania Uniform Commercial Code.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB![[Hamilton, Alexander] [Bank of New York] Partially-Printed "Receivable" for the Bank of New York](https://s1.img.bidsquare.com/item/l/9470/9470939.jpeg?t=1MwoER)

![[Hamilton, Alexander] [Bank of New York] Partially-Printed "Receivable" for the Bank of New York](https://s1.img.bidsquare.com/item/s/9470/9470939.jpeg?t=1MwoER)