1862 The Revenue Congressional Act of 1862 Funding the American Civil War

Lot 217

Estimate:

$600 - $800

Absentee vs Live bid

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $10 |

| $200 | $20 |

| $300 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

| $200,000 | $20,000 |

| $300,000 | $25,000 |

| $500,000 | $50,000 |

About Auction

By Early American History Auctions

Aug 24, 2019

Set Reminder

2019-08-24 12:00:00

2019-08-24 12:00:00

America/New_York

Bidsquare

Bidsquare : Autographs, Colonial Currency, Political Americana, Historic Guns

https://www.bidsquare.com/auctions/early-american-history-auctions/autographs-colonial-currency-political-americana-historic-guns-4347

Historic Autographs • Colonial Currency • American Civil War Colonial Era • Revolutionary War • Political Americana • Black History Early American History Auctions auctions@earlyamerican.com

Historic Autographs • Colonial Currency • American Civil War Colonial Era • Revolutionary War • Political Americana • Black History Early American History Auctions auctions@earlyamerican.com

- Lot Description

Civil War

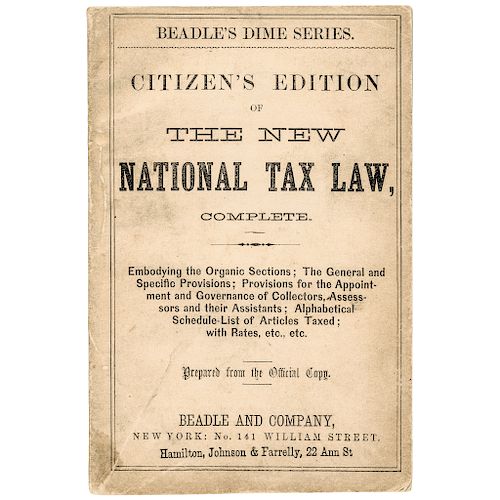

1862 "Citizen's Edition of The New National Tax Law" The Revenue Congressional Act of 1862 Funding the Civil War

1862-Dated Civil War Period, Revenue Act of 1862 Booklet titled, "Citizen's Edition of The New National Tax Law", Published by Beadle and Company, New York, Very Fine.

This historic Act also introduced the United States' First Progressive Tax with the intent of raising millions of dollars for the Union to help finance the cost of the Civil War. This Booklet measures about 4.5" x 6.5", 122 pages, plus cover. The Revenue Act of 1862 (July 1, 1862, Ch. 119, 12 Stat. 432), was a Bill the United States Congress passed to help fund the American Civil War. President Abraham Lincoln signed the Act into law on July 1, 1862. The Act established the office of the Commissioner of Internal Revenue, a department in charge of the collection of taxes, and levied excise taxes on most items consumed and traded in the United States. A nice lightly used copy with its full covers intact and interior very clean. An important step in American Taxation!

The American Civil War commenced in 1861 with the secession of many southern states (the group known as the Confederate States of America) from the United States (also known as the Union). In the early stages of the war, the Union believed that the conflict would be a relatively quick and easy victory. The federal government was in need of funding because of economic issues in the years leading up to the war, and as result, Congress' first attempt to fund the war came with the Act of July 17, 1861.

This Act authorized the Secretary of the Treasury Salmon P. Chase to raise money by issuing $50,000,000 in Treasury Notes. However, due to the deteriorating economic conditions of the years leading up to war, the production of these notes ceased, and they were officially declared "unredeemable".

As economic conditions worsened in the North, Chase needed to raise more revenue. He was initially opposed to the notion of internal taxes, and believed that the better way to raise revenue was through the selling of war bonds.

Citing the success of war bonds in raising revenue during the War of 1812, Chase consulted Philadelphia banker Jay Cooke to administer the sale of war bonds to citizens in the Union. Cooke was able to employ a sophisticated propaganda campaign to market bonds to the middle classes as well as to the upper classes, and was able to persuade almost one million northerners to invest, resulting in bond sales of over $3 billion.

However, the majority of these sales occurred during the later stages of the war, and the Union still needed an immediate method of raising funds.

Congress passed the Revenue Act of 1861 as an initial attempt to raise much-needed funds for the war.

This act levied the first ever income tax on American citizens. The income tax placed a 3% tax on all individuals whose annual incomes were above $800 per year. This would have resulted in the exemption of many citizens due to lower average income. However, by 1862, the United States government realized that the war would not end quickly, and that revenue gained by this income tax would not be sufficient. As a result, the Revenue Act of 1862 was passed in July 1862, before any income tax was collected under the first system.

- Shipping Info

-

Early American provides in-house worldwide shipping. Please contact us directly if you have questions about your specific shipping requirements.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB