1790 United States Loan Certificate By Congress, Continental Currency Redemption

Lot 147

Categories

Estimate:

$5,500 - $6,500

Absentee vs Live bid

Two ways to bid:

- Leave a max absentee bid and the platform will bid on your behalf up to your maximum bid during the live auction.

- Bid live during the auction and your bids will be submitted real-time to the auctioneer.

Bid Increments

| Price | Bid Increment |

|---|---|

| $0 | $10 |

| $200 | $20 |

| $300 | $25 |

| $500 | $50 |

| $1,000 | $100 |

| $2,000 | $200 |

| $3,000 | $250 |

| $5,000 | $500 |

| $10,000 | $1,000 |

| $20,000 | $2,000 |

| $30,000 | $2,500 |

| $50,000 | $5,000 |

| $100,000 | $10,000 |

| $200,000 | $20,000 |

| $300,000 | $25,000 |

| $500,000 | $50,000 |

About Auction

By Early American History Auctions

Jan 23, 2021

Set Reminder

2021-01-23 12:00:00

2021-01-23 12:00:00

America/New_York

Bidsquare

Bidsquare : Early American History Auction of Autographs, Americana, Political & Maps

https://www.bidsquare.com/auctions/early-american-history-auctions/early-american-history-auction-of-autographs-americana-political-maps-6311

311 Lots of Rare, Historic Autographs, Americana, Civil War Era, George Washington, Abraham Lincoln, Slavery & Black History, Revolutionary War Era, Colonial America, Federal Period, War of 1812, Colonial Currency, Indian Peace Medals & more... Early American History Auctions auctions@earlyamerican.com

311 Lots of Rare, Historic Autographs, Americana, Civil War Era, George Washington, Abraham Lincoln, Slavery & Black History, Revolutionary War Era, Colonial America, Federal Period, War of 1812, Colonial Currency, Indian Peace Medals & more... Early American History Auctions auctions@earlyamerican.com

- Lot Description

Federal Period

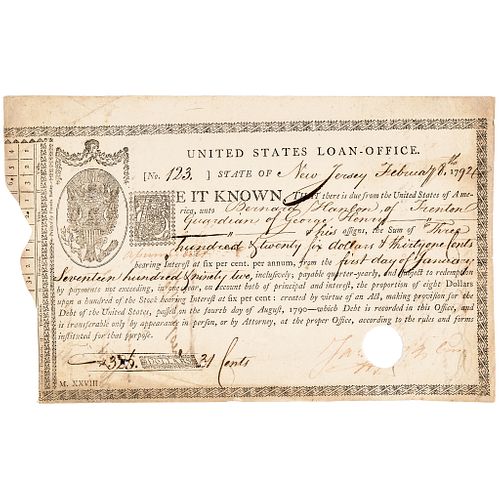

1790 United States Loan Office Certificate First Securities Type New York Stock Exchange Traded When Founded in 1792

1790 United States Loan Certificate or Stock of 1790, Funding of the Domestic Debt was provided by this Loan "By Act of Congress August 4th, 1790," meant for the redemption of the May 20, 1777 (First "UNITED STATES" titled Currency) and April 11, 1778 (Yorktown) Continental Currency Issues. This Certificate on the State of New Jersey. Bearing 6% Interest per annum. Bond for $326.31. Hessler X36A. Anderson US-197. Choice Very Fine.

Rated as Low Rarity-7 (7 to 12 Known) according to William Anderson. Anderson US-198. New Jersey. Issued Date of February 8, 1794 Federal Period, United States Loan Office. Certificate on the "State of New Jersey". 6% Bond for $326.31 Interest Payable from the first day of January 1792, payable quarter-yearly. Serial No. 123.

This United States Bond issued to "Bernard Hanlon of Trenton - Guardian of George Henry," Signed and Endorsed on the blank reverse. This specific design type with a Vignette of a boy's head above the Eagle in the Great Seal of the United States. Fancy Boxed "B" having small printed text "UNITED STATES LOAN OFFICE" in the design with vignette of a Snake beneath. "M. XXVIII." typeset in the lower left-hand corner. Signed by "Jabez Bowen" as Commissioner, standard small hole cancel in his signature. Safety numerals on indented border. Floral decorative border. Printed by Francis Bailey.

These Bonds were authorized on August 4, 1790 to fund Alexander Hamilton's financial program. These Certificates were the very First Securities that were traded when the New York Stock Exchange was founded in 1792. Among the Finest Known and Extremely Rare.

Under the U.S. Constitution of 1789, the new federal government enjoyed increased authority to manage U.S. finances and to raise revenues through taxation. Responsibility for managing debts fell to Secretary of the Treasury Alexander Hamilton.

Hamilton placed U.S. finances on firmer ground, allowing for the U.S. Government to negotiate new loans at lower interest rates. In addition, the United States began to make regular payments on in its French debts starting in 1790, and also provided an emergency advance to assist the French in addressing the 1791 Slave revolt that began the Haitian Revolution.

Although the federal government was able to resume debt payments, total federal expenditures exceeded revenues during many years in the 1790s. Alexander Hamilton therefore sought additional loans on Dutch capital markets, although the improved U.S. financial situation made these loans easier to obtain. These private loans from Dutch bankers also helped pay off loans owed to the Spanish Government, back pay owed to foreign officers, and U.S. diplomatic expenses in Europe.

In 1795, the United States was finally able to settle its debts with the French Government with the help of James Swan, an American banker who privately assumed French debts at a slightly higher interest rate. Swan then resold these debts at a profit on domestic U.S. markets. The United States no longer owed money to foreign governments, although it continued to owe money to private investors both in the United States and in Europe.

Although U.S. finances had been shaky under the Articles of Confederation, the United States was able to place itself on a sound financial footing during the 1790s. This enabled it to preempt diplomatic embarrassment and dependence on foreign powers during that period, and also improved U.S. credit on European capital markets, which enabled the U.S. Government to obtain low-interest loans for the Louisiana Purchase in 1803.

- Shipping Info

-

Early American provides in-house worldwide shipping. Please contact us directly if you have questions about your specific shipping requirements.

-

- Buyer's Premium

EUR

EUR CAD

CAD AUD

AUD GBP

GBP MXN

MXN HKD

HKD CNY

CNY MYR

MYR SEK

SEK SGD

SGD CHF

CHF THB

THB